Homeowners Insurance in and around Sugar Land

Sugar Land, make sure your house has a strong foundation with coverage from State Farm.

Help cover your home

Would you like to create a personalized homeowners quote?

What's More Important Than A Secure Home?

Your home and property have monetary value. Your home is more than just a roof and four walls. It’s all the memories attached to every room. Doing what you can to keep your home protected just makes sense! A great next step is to get outstanding homeowners insurance from State Farm.

Sugar Land, make sure your house has a strong foundation with coverage from State Farm.

Help cover your home

Don't Sweat The Small Stuff, We've Got You Covered.

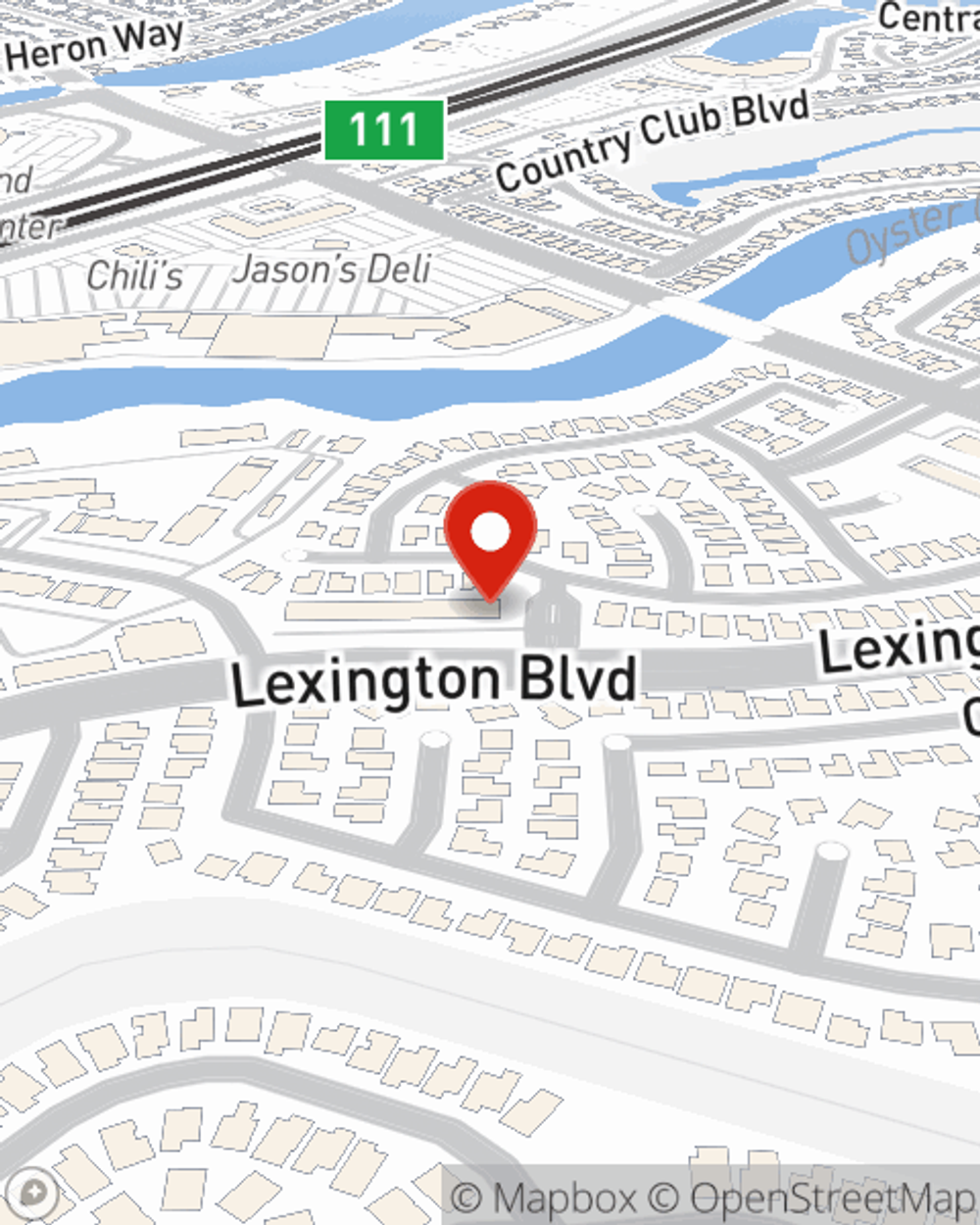

Are you looking for a policy that can help cover both your home and your mementos? State Farm agent Tracy Walker's team is happy to help you set up a plan that's right for your needs.

Having terrific homeowners insurance can be significant to have for when the unanticipated arises. Contact agent Tracy Walker's office today to figure out what works for your home insurance needs.

Have More Questions About Homeowners Insurance?

Call Tracy at (281) 265-0711 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

The pros and cons of paying off a mortgage early

The pros and cons of paying off a mortgage early

If you have extra funds, you may think about paying off a mortgage early. But review some key questions before you make that payment.

Tracy Walker

State Farm® Insurance AgentSimple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

The pros and cons of paying off a mortgage early

The pros and cons of paying off a mortgage early

If you have extra funds, you may think about paying off a mortgage early. But review some key questions before you make that payment.